Are you feeling the pinch in your pocket? With the cost of living on the rise, it's more important than ever to find ways to save money and stretch your hard-earned pounds. But what if we told you that saving money doesn't have to be a daunting task? In this comprehensive guide, we'll unveil 50 easy, actionable tips to help you save money in the UK every single month.

Key Takeaways

- Discover a wealth of practical strategies to save money every month

- Learn how to cut costs on everyday expenses like groceries and utilities

- Explore creative ways to save on transportation, entertainment, and leisure activities

- Optimise your monthly subscriptions and memberships for maximum savings

- Embrace a minimalist lifestyle and declutter to boost your financial freedom

Are you ready to take control of your finances and start saving like a pro? Dive into our expert tips and watch your savings grow month after month. Let's get started on your journey to financial freedom!

Apply now to "Personal Finance Easily Explained" Course and get 3 bonuses:

1. A daily expense tracker to monitor spending

2. A tool to evaluate investment performance

3. Retirement planning checklist

How to Effortlessly Cut Costs on Everyday Expenses

Navigating the cost of living in the UK can be challenging, but with the right strategies, you can save a substantial amount on everyday expenses. From savvy shopping for groceries to reducing utility bills, this section will guide you through a range of proven techniques to help you keep more of your hard-earned money.

Savvy Shopping Strategies for Groceries

Grocery shopping can quickly become a budget-drainer, but with a few simple tactics, you can save money on groceries UK and stretch your pounds further. Start by making a detailed list before you hit the supermarket, sticking to your essentials and avoiding impulse purchases. Additionally, take advantage of sales, discounts, and loyalty programmes to maximise your savings.

- Plan your meals in advance and create a shopping list to avoid overspending

- Compare prices and look for the best deals, both in-store and online

- Utilise coupons, vouchers, and loyalty card programmes to unlock savings

- Buy in bulk for non-perishable items to take advantage of lower unit prices

- Opt for own-brand or value-range products where quality is comparable to branded items

Reducing Utility Bills with Simple Tricks

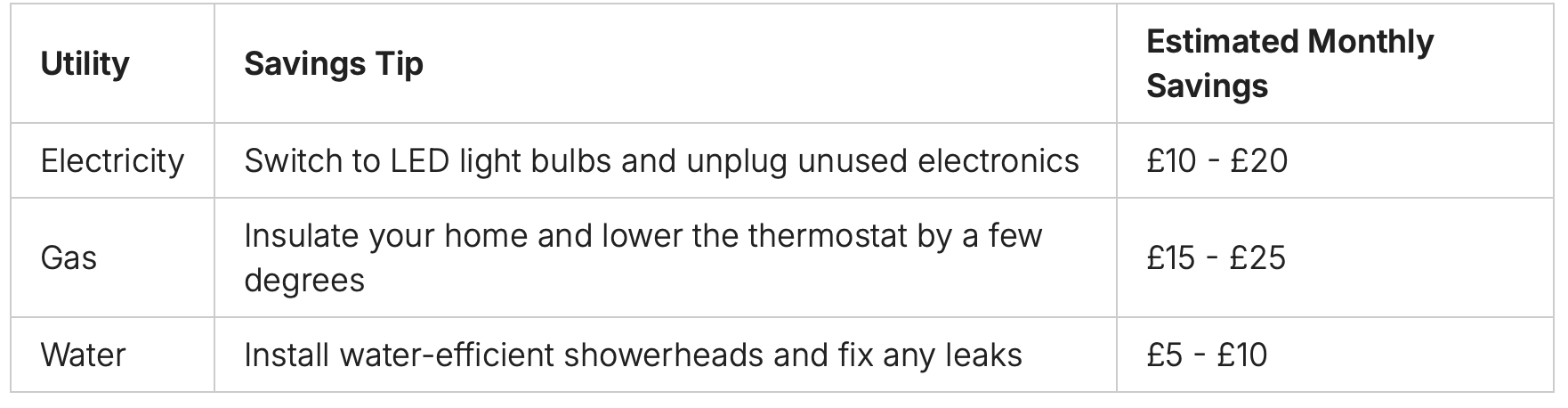

Utility bills can be a significant monthly expense, but there are several ways to reduce utility bills UK without compromising your comfort. Start by conducting an energy audit of your home to identify areas where you can improve efficiency, such as upgrading insulation or switching to energy-efficient appliances. Additionally, be mindful of your energy usage and adjust your habits accordingly.

By implementing these savvy shopping strategies and simple tricks to reduce utility bills, you can effortlessly cut costs on your everyday expenses and keep more of your hard-earned money.

Maximising Savings on Transportation Costs

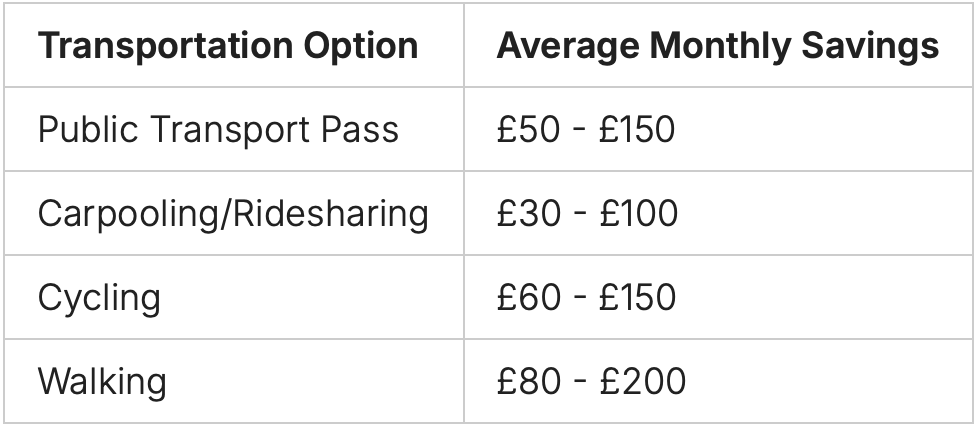

Reducing transportation expenses is a crucial aspect of saving money every month for UK residents. From cutting costs on commuting to finding smart ways to travel, this section explores various methods to minimise your spending on getting around.

Embrace Public Transport

Utilising public transport, such as buses, trains, and the underground, can be a cost-effective alternative to driving. Many cities and towns in the UK offer extensive public transport networks that can help you save money on transport. Look into monthly or annual passes, which often provide significant discounts compared to paying for individual journeys.

Carpool or Rideshare

Sharing the cost of fuel and other expenses by carpooling or using rideshare services can be an excellent way to cut costs on commuting in the UK. Reach out to colleagues, neighbours, or use online platforms to find others travelling in a similar direction and split the costs.

The table above demonstrates the potential monthly savings you can achieve by exploring alternative transportation options in the UK.

Embrace Active Commuting

If your work or home is within a reasonable distance, consider cycling or walking to work. Not only will this save money on transport, but it also offers health benefits and reduces your carbon footprint. Investigate local bike-sharing schemes or look into purchasing a second-hand bicycle to get started.

By implementing these strategies, you can significantly cut costs on commuting and keep more of your hard-earned money in your pocket each month.

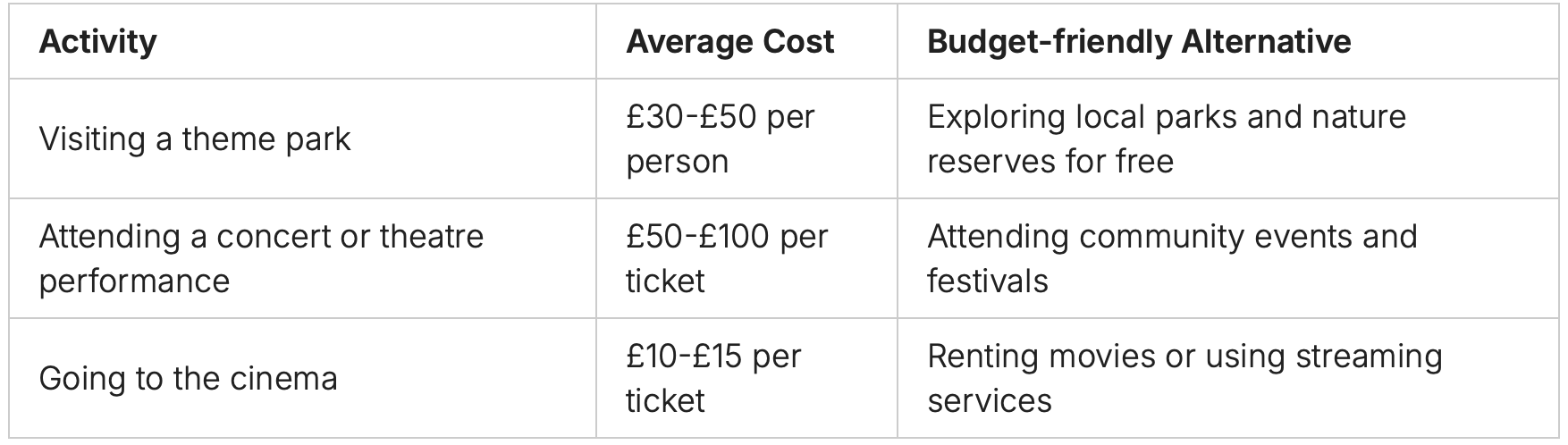

Money-saving Hacks for Entertainment and Leisure

In the UK, enjoying leisure activities doesn't have to break the bank. With a bit of creativity and smart planning, you can find plenty of budget-friendly options to keep yourself entertained. From free local events to discounted movie tickets, there are numerous ways to save money on entertainment and leisure.

Affordable Staycation Ideas

One of the best ways to save money on entertainment is to explore your local area through a budget-friendly staycation. Instead of expensive trips, consider discovering the hidden gems right in your own backyard. Visit nearby museums, take a day trip to a nearby town, or enjoy a scenic hike in the countryside. Not only will this save you money on travel costs, but it can also be a great way to appreciate the beauty and culture of your local community.

- Explore local parks and nature reserves for free outdoor activities

- Visit museums and galleries on free admission days

- Attend community events and festivals in your area

- Discover historical sites and landmarks close to home

- Enjoy a picnic at a scenic local spot

By embracing the concept of the budget-friendly staycation, you can save money on entertainment UK and enjoy a fulfilling leisure experience right in your own backyard.

"Exploring your local area can be just as exciting as an international trip, and it can save you a lot of money in the process."

By taking advantage of these save money on entertainment UK strategies, you can enjoy a fulfilling leisure experience without breaking the bank.

It's your money, and it's time for you to take control!

Don’t let financial confusion hold you back.

Enrol in "Personal Finance Easily Explained" now and take the first step towards a stable and prosperous financial future.

Enrol in "Personal Finance Easily Explained" now and take the first step towards a stable and prosperous financial future.

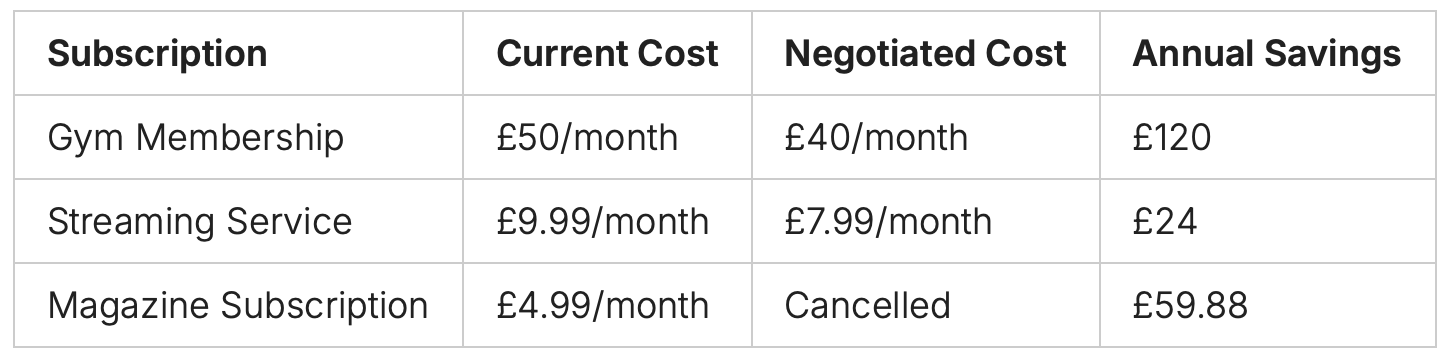

Optimising Your Monthly Subscriptions and Memberships

Cutting down on unused or unnecessary monthly subscriptions and memberships can be a game-changer when it comes to saving money in the UK. Many people are unknowingly wasting precious pounds on services they rarely use, hindering their ability to build up substantial savings. This section explores practical strategies to identify and manage these recurring expenses, freeing up funds to allocate towards your financial goals.

Conduct a Subscription Audit

The first step to optimising your monthly expenses is to conduct a thorough audit of all your active subscriptions and memberships. Review your bank statements and credit card bills to uncover any forgotten or underutilised services. This could include gym memberships, streaming platforms, magazine subscriptions, or even online tools and software.

- List out all your current subscriptions and memberships

- Assess how frequently you use each service

- Identify any that you can easily cancel or downgrade

Renegotiate or Cancel Unnecessary Expenses

Once you have a clear picture of your subscriptions, it's time to take action. Reach out to the providers and inquire about any opportunities to reduce your monthly payments or cancel the subscription altogether. Many companies are willing to offer discounts or special rates to retain customers, so don't be afraid to negotiate.

By taking the time to review and optimise your monthly subscriptions and memberships, you can potentially save hundreds of pounds each year. These simple steps can have a significant impact on your overall financial well-being, freeing up funds to allocate towards reducing monthly subscriptions UK and saving money on memberships UK.

Save money tips UK, monthly saving tips UK

The UK is a country where saving money can be a real challenge, but with the right strategies, you can maximise your savings every month. In this section, we've compiled a comprehensive list of practical save money tips UK and monthly saving tips UK to help you reach your financial goals.

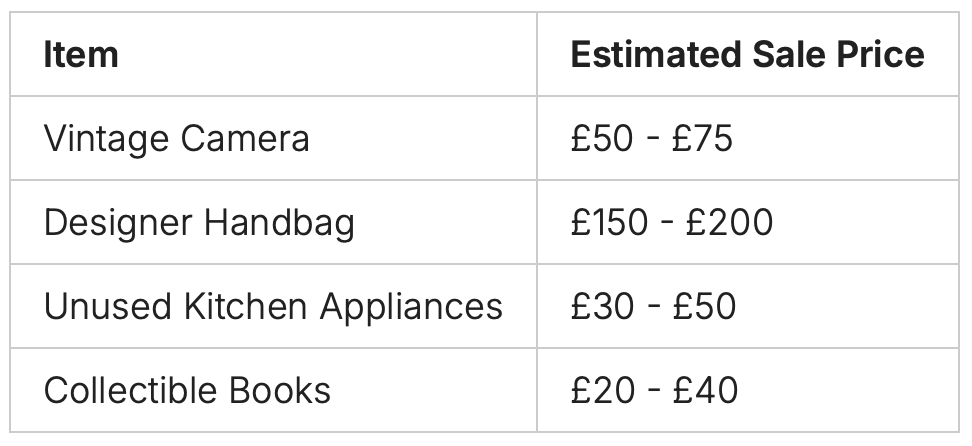

- Embrace a minimalist lifestyle: Declutter your home and sell unwanted items to generate extra cash flow.

- Negotiate better deals on recurring expenses: From your broadband and utilities to your gym membership, don't be afraid to haggle for a better price.

- Leverage technology to automate your savings: Utilise budgeting apps and online tools to track your spending and set up automatic transfers to your savings account.

- Prioritise DIY home improvements: From simple DIY projects to larger renovations, taking on tasks yourself can save you a significant amount of money.

- Explore affordable staycation ideas: Discover the hidden gems in your own backyard and enjoy a budget-friendly holiday close to home.

Remember, the key to successful monthly saving tips UK is to find the right balance between cutting costs and maintaining a comfortable lifestyle. By implementing these save money tips UK, you'll be well on your way to reaching your financial goals and enjoying a more secure financial future.

"The secret to saving money is to spend less than you earn."

Embracing a Minimalist Lifestyle for Financial Freedom

The journey to financial freedom often begins with a shift in mindset. By embracing a minimalist living UK approach, you can uncover new avenues to save money and achieve greater financial stability. Minimalism is not just about decluttering your physical space; it's a holistic lifestyle that encourages mindful consumption, intentional living, and the cultivation of true prosperity.

Decluttering and Selling Unwanted Items

One of the cornerstones of minimalist living UK is the art of decluttering. Take a critical look at your possessions and identify items that no longer serve you or bring joy to your life. By letting go of these declutter and sell UK items, you can not only free up valuable living space but also generate extra cash flow.

Consider these steps to start your decluttering journey:

- Conduct a room-by-room assessment, identifying items that can be sold, donated, or recycled.

- Research the best platforms and channels to sell your unwanted items, such as online marketplaces, consignment shops, or even hosting a garage sale.

- Carefully price your items to ensure a fair and competitive offering, and be prepared to negotiate politely with potential buyers.

- Invest the proceeds from your sales into building your financial reserves or paying off debts, further strengthening your path to financial freedom.

By embracing a minimalist living UK approach and decluttering and selling UK unwanted items, you can unlock new financial opportunities and move closer to your goals of financial freedom.

"The ability to simplify means to eliminate the unnecessary so that the necessary may speak." - Hans Hofmann

Negotiating Better Deals on Recurring Expenses

As UK residents, we often find ourselves paying more than necessary for essential recurring expenses like insurance, internet, and mobile phone contracts. However, with a little effort, you can negotiate better rates and lower your monthly costs. By harnessing the power of negotiation, you can save money UK and keep more of your hard-earned cash.

The key to successful negotiations lies in being prepared and confident. Start by researching the current market rates for the services you use, so you have a good understanding of the competitive landscape. Armed with this knowledge, you can approach service providers and politely request a better deal.

- Contact your insurance provider and inquire about any discounts or loyalty programmes they offer. Emphasise your long-standing relationship and enquire about ways to reduce your premiums.

- When your internet or mobile phone contract is due for renewal, don't simply accept the standard offer. Instead, call the customer retention department and negotiate a lower rate. Mention any special offers or promotional deals they are currently providing to new customers.

- Consider bundling services, such as internet, TV, and mobile, to take advantage of discounted package deals. Service providers are often willing to offer better rates to retain a customer's full business.

Remember, the goal is to negotiate bills UK and lower recurring expenses UK without compromising the quality of service you receive. With a little persistence and a polite, yet firm, approach, you can secure more favourable terms and keep more money in your pocket each month.

"Negotiating is not about winning or losing; it's about finding a mutually beneficial solution."

Leveraging Technology to Automate Savings

In today's digital age, there's no shortage of innovative apps and online tools that can help UK residents effortlessly manage their finances and automate savings. By harnessing the power of technology, individuals can streamline their budgeting process, track expenses, and seamlessly allocate funds towards their savings goals.

Apps and Online Tools for Budgeting

Budgeting apps like Yolt, Emma, and Money Dashboard have revolutionised the way people in the UK manage their money. These intuitive platforms connect to your bank accounts, allowing you to categorise and monitor your expenses with ease. Some key features of these budgeting apps UK include:

- Automatic expense tracking and categorisation

- Real-time budgeting insights and spending analysis

- Customisable savings goals and automatic transfers

- Personalised recommendations for cost-cutting opportunities

Meanwhile, online tools like Snoop and Chip take the automation a step further by using algorithms to monitor your spending patterns and automatically transfer small amounts into a savings account. This "set-and-forget" approach makes it easier than ever to build up your savings with minimal effort.

"Automating my savings has been a game-changer. I no longer have to remember to transfer money – it just happens seamlessly in the background."

– Emily, a Manchester-based financial blogger

By embracing these innovative automate savings UK tools, UK residents can take control of their finances, achieve their savings goals, and enjoy greater financial peace of mind.

DIY Projects to Save Money on Home Improvements

Undertaking do-it-yourself (DIY) projects for home improvements and repairs can be a fantastic way for UK residents to save money. By rolling up your sleeves and tackling tasks yourself, you can avoid the expensive labour costs associated with hiring professional contractors. From simple fixes to more ambitious renovations, DIY projects offer a cost-effective solution to maintain and upgrade your living space.

Whether you're looking to spruce up your kitchen, renovate your bathroom, or tackle a garden makeover, there are plenty of DIY home improvement ideas that can help you save money on home repairs UK. By learning basic skills and taking on hands-on tasks, you can not only cut costs but also develop a sense of accomplishment and personal pride in your work.

Practical DIY Tasks for the Home

- Painting and decorating: Give your walls a fresh new look by painting them yourself, rather than hiring a professional painter.

- Tiling: Lay new tiles in your bathroom or kitchen, saving on the cost of a professional tiler.

- Flooring: Install laminate, vinyl, or hardwood flooring yourself, avoiding the labour fees of a professional installer.

- Gardening and landscaping: Tackle garden maintenance, planting, and landscaping projects to enhance your outdoor living space.

- Minor plumbing and electrical work: Tackle simple fixes like unblocking drains, changing taps, or replacing light fittings.

By embracing a DIY home improvements UK mindset, you can significantly reduce the costs associated with home maintenance and upgrades. With a little time, effort, and the right tools, you can transform your living space without breaking the bank.

By taking on these DIY projects, you can enjoy the satisfaction of a job well done and the financial benefits of saving money on home repairs UK. With a little creativity and determination, your home improvement journey can be both rewarding and cost-effective.

Conclusion

As we've explored throughout this comprehensive guide, there are countless ways for UK residents to save money each month and build a stronger financial foundation. From strategic grocery shopping and utility bill reductions to leveraging technology and embracing a more minimalist lifestyle, the tips and strategies covered can truly make a tangible difference in your savings.

Ultimately, the key is to adopt a savings-focused mindset and incorporate these money-saving techniques into your daily routines. Whether it's meal planning, optimising your subscriptions, or tackling home improvement projects yourself, each small step you take can add up to significant monthly savings. Remember, every pound you stash away today is an investment in your future financial security.

So, take the time to review the insights shared in this article, and start implementing the save money UK and monthly savings tips UK that resonate most with your unique circumstances. With a little bit of effort and commitment, you'll be well on your way to building a healthier savings account and achieving greater financial freedom.

Frequently Asked Questions

What are some of the key topics covered in this guide?

This comprehensive guide explores a wide range of practical tips and strategies to help UK residents save money every month. The topics covered include savvy shopping for groceries, reducing utility bills, maximising savings on transportation costs, finding affordable entertainment and leisure activities, optimising monthly subscriptions and memberships, embracing a minimalist lifestyle, negotiating better deals on recurring expenses, leveraging technology to automate savings, and undertaking DIY home improvements.

What are some affordable staycation ideas?

The guide provides money-saving hacks for entertainment and leisure, including affordable staycation ideas that allow UK residents to explore their local area without incurring significant costs, such as visiting free museums, parks, and historic sites, or planning activities like hiking, picnicking, or discovering hidden gems in their own city.

How can I cut costs on my weekly food shop?

The guide provides several savvy shopping strategies for groceries, such as making a meal plan, sticking to a shopping list, taking advantage of loyalty programmes, comparing prices across different supermarkets, and learning to cook more budget-friendly meals at home.

How can I reduce my monthly subscriptions and memberships?

The guide offers strategies to identify and cancel or renegotiate recurring expenses, such as regularly reviewing bank and credit card statements, contacting service providers to negotiate better rates, and considering whether certain memberships or subscriptions are truly necessary.

What are some effective ways to reduce my utility bills?

The guide offers simple tricks to lower utility bills without sacrificing comfort, including adjusting heating and cooling settings, switching to energy-efficient lightbulbs, unplugging unused appliances, and regularly maintaining household systems like boilers and insulation.

What are the benefits of embracing a minimalist lifestyle?

The guide explores how adopting a minimalist mindset can be a powerful tool for achieving financial freedom. It provides guidance on decluttering and selling unwanted items to generate extra cash flow, as well as the broader benefits of minimalism, such as reducing waste, increasing focus, and cultivating a greater appreciation for the essentials.

How can I save money on my daily commute?

The guide explores various methods for UK residents to minimise their spending on transportation, such as using public transport, cycling or walking, carpooling with colleagues, and optimising routes and schedules to reduce fuel consumption.

How can I negotiate better deals on my recurring expenses?

The guide offers strategies and tips to help UK residents engage in effective negotiations with service providers, such as insurance companies, internet and mobile providers, and other recurring expense vendors, to secure more favourable terms and lower their monthly bills.

Transform Your Finances in 12 Steps

Get the tools you need to achieve peace of mind and financial security. We find out what works, and then clarify it, simplify it, and systematise it in a way to help people move forward.